- Table View

- List View

A Lexicon of Social Well-Being

by Luigino BruniWe must quickly learn how to live well in the world as it is today, including the realm of work. We need to learn a new vocabulary of economics and markets that is more suitable to understand the present world and that is likely to offer us the tools to act, and perhaps improve it as well.

A Life Among the Dead: Stories from an Irish Funeral Director

by David McGowanWhen death is a way of life . . .In A Life Among the Dead, David McGowan, Ireland's best known Funeral Director, and subject of the Award-winning Netflix documentary The Funeral Director, guides us through the business, the science and the unexplained elements of death.Alongside exploring the unique approach of Irish culture when it comes to grief and death, David seeks to demystify the process of dying and what happens to the body afterward.The only certainty when we come into this life is that we are going to leave it, and yet it's something most people are reluctant to discuss or allow themselves to think about. David's mission is to open up conversations and encourage people to have an understanding of their loved ones wishes as well as their own.Poignant, humorous and educational, this is an account of a life lived with purpose in the service of the dead.

A Life Among the Dead: Stories from an Irish Funeral Director

by David McGowanWhen death is a way of life . . .In A Life Among the Dead, David McGowan, Ireland's best known Funeral Director, and subject of the Award-winning Netflix documentary The Funeral Director, guides us through the business, the science and the unexplained elements of death.Alongside exploring the unique approach of Irish culture when it comes to grief and death, David seeks to demystify the process of dying and what happens to the body afterward.The only certainty when we come into this life is that we are going to leave it, and yet it's something most people are reluctant to discuss or allow themselves to think about. David's mission is to open up conversations and encourage people to have an understanding of their loved ones wishes as well as their own.Poignant, humorous and educational, this is an account of a life lived with purpose in the service of the dead.

A Life Course Perspective on Chinese Youths: From the Transformation of Social Policies to the Individualization of the Transition to Adulthood (Life Course Research and Social Policies #17)

by Sandra V. ConstantinThis open access book investigates from a life-course perspective the individualization process and the challenges faced by young adults in post-collectivist China, where people are enjoined to "liberate" (jiefang) their individual capacities, to "rely on themselves" (kao ziji) and to no longer "depend on the state" (kao guojia). Based on unique quantitative and qualitative data, this book provides a solid empirical portrait of Chinese youths and transformation of social policies in post-collectivist ChinaThis book will be a great resource to students, academics as well as social scientists and policy-makers who wish not only to understand how, in such a short period of time, young adults and their families have managed to navigate from a relatively egalitarian society to one of the most unequal, but also how the articulation between socialist and neoliberal ideologies is reconfiguring social and economic relations as well as women’s and men’s life-course.The basis of the English translation of this book from its French original manuscript was done with the help of artificial intelligence. A subsequent human revision and rewriting of the content was done by the author.

A Life Less Ordinary

by Baby HalderThis is the story of Baby Halder, a young woman working as a domestic in a home in Delhi. Hurriedly married off at the age of twelve, a mother by the time she was fourteen, Baby writes movingly and evocatively of her life as a young girl, and later as a young woman. The long absences of her father, the hardships faced by her mother, and her decision to walk out of her marriage, leaving Baby and her sister to manage the household, were the realities that shaped Baby's early life. When marriage came, Baby, still a child, yearned to play and study, but was burdened with the responsibility of being wife and mother while facing considerable violence from her husband. Escape finally came many years later, by which time the still young Baby was a mother of three, and she fled to the city in the hope of finding a job. Working in Delhi as a domestic help, Baby was lucky enough to come across an employer who encouraged her to read - which she did voraciously - and then to write. The story of Baby's life is a lesson in courage and survival. Since it was first published in Hindi, this book has become a bestseller, receiving accolades from some of the best-known writers and critics in India and elsewhere. It has also been translated into other Indian languages.

A Life Lived Remotely

by Siobhan McKeownWhat happens when we take our lives online? How are we being changed by immersion in the internet? How do we know the difference between work and life when one seems to blend into the other?Part memoir, part theory, A Life Lived Remotely tells the story of a transition to the digital age. It follows the author's journey through remote work, framing it within the exponential growth of the internet and the rapid spread of neoliberalism. It examines how we are being changed by the internet, how we experience that change, and at the anxieties and issues that arise. A moment's pause in a world of fast-paced communication, it provides a critical reflection on what it means to come of age along with the internet.

A Life Well Lived: Dialogues with a “Kabouter"

by Manfred F. Kets de VriesManfred Kets de Vries wears many “hats”—psychoanalyst, executive coach, consultant, management educator, researcher, writer—but he has noticed that whichever hat he is wearing, every question he is asked boils down to one thing: “How can I live a well-lived life?” Over many years of practice in all these disciplines, Professor Kets de Vries has realized the unsurpassed value of stories in tackling human dilemmas and providing answers to this question. The book is, therefore, one of the most important books he has written for coaches, students, leaders, managers, educators—or anyone seeking a more reflective text to guide them through the multitude of questions that we face in work and in life. He draws on a long literary tradition of the unexpected encounter with a wise “other,” fantastic or magical—think The Little Prince, Alice's Adventures in Wonderland, The Once and Future King, the Harry Potter novels—to animate an exploration of the deepest questions and concerns of human beings. He constructs an extended Socratic dialogue between his two “selves”; the first a naïve traveler, lost in the Siberian wilderness, and the second a reflective avatar who comes to his aid. The avatar takes the form of a “kabouter,” a familiar figure in Dutch folklore whose counterpart can be found in different cultures around the world and throughout centuries of storytelling. Through stories, riddles, and puzzles, the kabouter challenges the traveler to question and reflect upon his life and values, guiding him—and readers—toward the insights that will help them achieve a life well lived.

A Life against the Grain: The Autobiography of an Unconventional Economist

by Julian L. SimonIn his long and distinguished career as a writer and scholar Julian Simon came to be known as one of the leading--and most controversial--authorities on population economics. An immensely productive writer, his work is unified by a basic core belief: that human intellect and ingenuity are ever-renewable resources in the use and preservation of natural resources. Inevitably, Simon's position provoked the hostility of doctrinaire environmentalists, both in academia and in the movement at large. However, Simon's arguments were invariably built from facts and powerful evidence that stood him well in many high-profile public debates. The first part of Simon's autobiography takes the reader through his childhood, his years as a midshipman and then as an officer in the Navy, plus a stint in the Marines, and his experiences as a copywriter in an advertising firm. Simon's plan after receiving his Ph.D. from the University of Chicago was to be an entrepreneur, which would afford him enough money to care for his parents and allow him free time for writing fiction. He ran a small mail-order business for two years, during which time he wrote his first book, How to Start and Operate a Mailorder Business, which has since gone through seven editions. Deciding to seek a professional career, in 1963, he accepted a position at the University of Illinois. Although he spent thirty-five years of his life as a faculty member at three universities, his autobiography contains almost no discussion of departmental affairs or university politics, topics about which Simon had little or no interest. Rather, after the personal chronology and experiences, the book includes substantive chapters on research methods, population economics, and immigration. It also explains how Julian Simon became the economist he was. He analyzes crucial periods in his life when he developed his ideas on fundamental issues. Written in an engaging and amusing manner, Julian Simon's autobiography is a combination of personal memoir and professional contribution to important ideas in economics, research methods, and demography. His observations and personal reflections will interest the general reader on a humanitarian level as well as environmentalists, sociologists, and economists on a professional level.

A Life at Work: The Joy of Discovering What You Were Born to Do (Playaway Adult Nonfiction Ser.)

by Thomas MooreA job is never just a job. It is always connected to a deep and invisible process of finding meaning in life through work. In Thomas Moore’s groundbreaking bookCare of the Soul, he wrote of “the great malady of the twentieth century…the loss of soul. ” That bestselling work taught readers ways to cultivate depth, genuineness, and soulfulness in their everyday lives, and became a beloved classic. Now, inA Life’s Work, Moore turns to an aspect of our lives that looms large in our self-regard, an aspect by which we may even define ourselves—our work. The workplace, Moore knows, is a laboratory where matters of soul are worked out. A Life’s Workis about finding the right job, yes, and it is also about uncovering and becoming the person you were meant to be. Moore reveals the quest to find a life’s work in all its depth and mystery. All jobs, large and small, long-term and temporary, he writes, contribute to your life’s work. A particular job may be important because of the emotional rewards it offers or for the money. But beneath the surface, your labors are shaping your destiny for better or worse. If you ignore the deeper issues, you may not know the nature of your calling, and if you don’t do work that connects with your deep soul, you may always be dissatisfied, not only in your choice of work but in all other areas of life. Moore explores the often difficult process—the obstacles, blocks, and hardships of our own making—that we go through on our way to discovering our purpose, and reveals the joy that is our reward. He teaches us patience, models the necessary powers of reflection, and gives us the courage to keep going. A Life’s Workis a beautiful rumination, realistic and poignant, and a comforting and exhilarating guide to one of life’s biggest dilemmas and one of its greatest opportunities.

A Life in Error: From Little Slips to Big Disasters

by James ReasonThis succinct but absorbing book covers the main way stations on James Reason’s 40-year journey in pursuit of the nature and varieties of human error. In it he presents an engrossing and very personal perspective, offering the reader exceptional insights, wisdom and wit as only James Reason can. The journey begins with a bizarre absent-minded action slip committed by Professor Reason in the early 1970s - putting cat food into the teapot - and continues up to the present day, conveying his unique perceptions into a variety of major accidents that have shaped his thinking about unsafe acts and latent conditions. A Life in Error charts the development of his seminal and hugely influential work from its original focus into individual cognitive psychology through the broadening of scope to embrace social, organizational and systemic issues. The voyage recounted is both hugely entertaining and educational, imparting a real sense of how James Reason’s ground-breaking theories changed the way we think about human error, and why he is held in such esteem around the world wherever humans interact with technological systems. This book is essential reading for students, academics and safety professionals of all kinds who are interested in avoiding breakdowns that can cause serious damage to people, assets and the environment.

A Life in Our Times

by John Kenneth GalbraithThe chapters on his ambassadorship to India during the Sino-Indian war, on the Vietnam war, and on Lyndon Johnson will provide historians with some new footnotes. Without Galbraith the political literature of our time would be far drearier.

A Life in Pattern: And how it can make you happy without you even noticing

by Orla KielyOrla Kiely has opened her archives to explore a life dedicated to print. From her earliest and most iconic pattern, Stem, to the evolution of her print design encompassing the worlds of fashion, homewares and beyond, Orla shares the full range of patterns and designs that she has produced since establishing her brand in 1995.This is a celebration of Orla's entire body of work - of colour, of print and of a handbag loved by women all over the world.Foreword written by Leith Clark, founder of The Violet Book and previously Lula magazine.

A Life of Experimental Economics, Volume I: Forty Years of Discovery

by Vernon L. SmithThis book provides an intimate history of Nobel Laureate Vernon Smith’s early life, combining elements of biography, history, economics and philosophy to show how crucial incidents early in his life provided the necessary framework for his research into experimental economics. Smith takes the reader from his family roots on the railroads and oil fields of Middle America to his early life on a farm in Depression-wracked Kansas. A mediocre student in high school, Smith attended Friends University, on Wichita’s west side, where an intense study of mathematics, physics, chemistry, and astronomy enabled him to pass the examinations to enter Caltech and study under luminary scientists like Linus Pauling. Eventually Smith discovered economics and pursued graduate study in the field at University of Kansas and Harvard. This volume ends with his Camelot years at Purdue, where he began his famous work in experimental economics, nurturing his research into an unlikely new field of economics.

A Life of Experimental Economics, Volume II: The Next Fifty Years

by Vernon L. SmithThis sequel to A Life of Experimental Economics, Volume I, continues the intimate history of Vernon Smith’s personal and professional maturation after a dozen years at Purdue. The scene now shifts to twenty-six transformative years at the University of Arizona, then to George Mason University, and his recognition by the Nobel Prize Committee in 2002. The book ends with his most recent decade at Chapman University. At Arizona Vernon and his students studied asset trading markets and learned how wrong it had been to suppose that price bubbles could not occur where markets were full-information transparent. Their work in computerization of the lab facilitated very complex supply and demand experiments in natural gas pipeline, communication and electricity markets that paved the way for implementing, through decentralized market processes, the liberalization of industries traditionally believed to be “natural” monopolies. The “Smart Computer Assisted Market” was born. Smith’s move to George Mason University greatly facilitated government and industry work in tandem with various public and private entities, whereas his relocation to Chapman University coincided with the Great Recession, whose similarity with the Depression was evident in his research. There he integrated two fundamental kinds of markets with laboratory experiments: Consumer non-durables, the supply and demand for which was stable in the lab and in the economy, and durable assets whose bubble tendencies made them unstable in the lab as well as in the economy—witness the great housing-mortgage market bubble run-up of 1997-2007. This book’s conversational style and emphasis on the backstory of published research accomplishments allows readers an exclusive peak into how and why economists pursue their work. It’s a must-read for those interested in experimental economics, the housing crisis, and economic history.

A Little Book for New Bible Scholars (Little Books)

by E. Randolph Richards Joseph R. DodsonMany young Bible scholars are passionate for the Scriptures. But is passion enough?A Little Book for New Bible Scholars

A Little Book for New Scientists: Why and How to Study Science (Little Books)

by Josh A. Reeves Steve DonaldsonMany young Christians interested in the sciences have felt torn between two options: remaining faithful to Christ or studying science. Heated debates over the past century have created the impression that we have to choose between one or the other. The result has been a crisis of faith for many students. Josh Reeves and Steve Donaldson present a concise introduction to the study of science that explains why scientists in every age have found science congenial to their faith and how Christians in the sciences can bridge the gap between science and Christian belief and practice. If Christians are to have a beneficial dialogue with science, it will be guided by those who understand science from the inside. Consequently, this book provides both advice and encouragement for Christians entering or engaged in scientific careers because their presence in science is a vital component of the church's witness in the world.

A Little Crazy: A Memoir of Finding Purpose and Joy Amid the Madness

by David MageeFrom the father who won over critics and readers with Dear William, a memoir about his late son, comes David Magee&’s own story of recovery from addiction—all while battling ADHD, depression, anxiety, as well as grief and a costly midlife crisis. A Little Crazy is a powerful call to action to embrace differences and create a life unbound by stigma and stereotypes, leading to redeeming purpose and joy. Adopted into a family that never quite fit, David Magee battled loneliness and a lack of self-esteem as a teen. These feelings followed and paralyzed him into adulthood until a trusted voice within revealed an unusual—if not a little bit crazy—path forward. Despite difficulties, he followed that path relentlessly, learning to better manage his mental-health adversities and making them his most vital assets. Follow David&’s story as he turns his life around, saving his marriage and career, and becomes a trusted voice in breaking mental health and substance misuse stigma among students and parents nationally, all while leading the way in creating a university institute focused on finding solutions to student and family well-being. A trusted voice in the mental health and substance misuse space, known from his work advocating for student and family well-being nationally, David&’s inspiring journey teaches readers: The power of believing in something bigger The importance of trusting and following instinct The reality that we can&’t do it alone How speaking our truth frees us and helps others In sharing his inspiring journey, David teaches readers the importance of trusting your instincts, speaking your truth, and understanding the reality that no one can succeed alone.

A Little History of Economics

by Niall KishtainyA lively, inviting account of the history of economics, told through events from ancient to modern times and the ideas of great thinkers in the field What causes poverty? Are economic crises inevitable under capitalism? Is government intervention in an economy a helpful approach or a disastrous idea? The answers to such basic economic questions matter to everyone, yet the unfamiliar jargon and math of economics can seem daunting. This clear, accessible, and even humorous book is ideal for young readers new to economics and for all readers who seek a better understanding of the full sweep of economic history and ideas. Economic historian Niall Kishtainy organizes short, chronological chapters that center on big ideas and events. He recounts the contributions of key thinkers including Adam Smith, David Ricardo, Karl Marx, John Maynard Keynes, and others, while examining topics ranging from the invention of money and the rise of agrarianism to the Great Depression, entrepreneurship, environmental destruction, inequality, and behavioral economics. The result is a uniquely enjoyable volume that succeeds in illuminating the economic ideas and forces that shape our world.

A Little Knowledge Is a Dangerous Thing

by Dale NeefIt is said that a little knowledge is a dangerous thing. It is a time honored cautionary statement that has suddenly acquired a new urgency. A little knowledge is dangerous, because as a force for dramatic change, knowledge today is revolutionary. More is known and being learned everyday than was ever known or learned before. As a direct result, the pace of change-and that means change in the sense of everything from business to economics, science, medicine, and politics-is beginning to accelerate much more rapidly than ever before in mankind's history.The purpose of this book then is twofold. First it is to provide a broader case for action for knowledge management-to explain what it is, why it has come about and why it is important. In this regard, we take a step back and try to understand the root causes behind the knowledge management techniques are very different, and in many ways more important, than the sort of process or productivity improvement techniques we have dealt with before. "Brains, not brawn. The success of countries, companies and people in the next century will depend on what they know and how clever they are at using this knowledge. Dale Neef has given us the best outline yet of the forces behind this extraordinary change in the world economy, the threats and opportunities we all face, and the prizes that await the winners."-Hamish McRae, author, The World in 2020, Associate editor, "The Independent", London"Dale Neef has produced a singular achievement: a book which lucidlyexplains the powerful driving role being played by knowledge in the emerging global economy. He provides a penetrating, all-too-rare trans-national perspective which highlights in a highly readable manner the historical, social and technological context within which this revolution is taking place. In doing so, he has stripped away the hype and jargon with which many knowledge management "experts" have clouded this structural change in the global economy. Mr. Neef offers a fascinating array of facts to support his explanations and goes on to discuss the implications of these developments for managers, for companies and for national governments. This book is a must-read for anyone actively engaged in global business today."-Jon Lowe, Former U.S. Deputy Assistant Secretary of Labor"A Little Knowledge Is a Dangerous Thing provides a very comprehensive view of the impact that the knowledge revolution on our 21st Century society. The economic dislocations that Dale Neef describes are already taking place, creating the prospect that large segments of our population may not have the skills for sustainable employment in the future. The implications of these events on the social and political fabric of our country give one great pause for reflection and concern."-William R. Brody, President, The Johns Hopkins University"Once again, Dale Neef combines just the right amounts of theory, academia and practical business experience to write a truly insightful book. In his consulting work, Mr. Neef's broad business, cultural and educational background has allowed him to analyze problems from a rich variety of perspectives. In this book, he artfully applies this skill to Knowledge Management."-James R. Breakey, Senior Vice President, Chief Information Officer, Green Tree Financial Corporation"This book is full of facts... that we need to understand if we are to draw critical conclusions about how the knowledge economy is impacting our businesses and our lives. Neef provides us with a broad perspective, concentrating not just on the US, but including insightful comparisons with Canada and Europe as well as many developing countries. The numbers provide an eye opening look at what has changed and what is changing in the knowledge economy...It is a book that challenges our thin

A Liverpool Merchant House: Being the History of Alfreed Booth & Co. 1863-1959

by A.H JohnFirst Published in 2005. Routledge is an imprint of Taylor & Francis, an informa company.

A Living Wage: American Workers and the Making of Consumer Society

by Lawrence B. GlickmanThe fight for a "living wage" has a long and revealing history as documented here by Lawrence B. Glickman. The labor movement's response to wages shows how American workers negotiated the transition from artisan to consumer, opening up new political possibilities for organized workers and creating contradictions that continue to haunt the labor movement today. Nineteenth-century workers hoped to become self-employed artisans, rather than permanent "wage slaves." After the Civil War, however, unions redefined working-class identity in consumerist terms, and demanded a wage that would reward workers commensurate with their needs as consumers. This consumerist turn in labor ideology also led workers to struggle for shorter hours and union labels. First articulated in the 1870s, the demand for a living wage was voiced increasingly by labor leaders and reformers at the turn of the century. Glickman explores the racial, ethnic, and gender implications, as white male workers defined themselves in contrast to African Americans, women, Asians, and recent European immigrants. He shows how a historical perspective on the concept of a living wage can inform our understanding of current controversies.

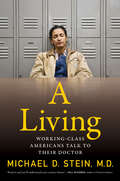

A Living: Working-Class Americans Talk to Their Doctor

by Michael D. SteinFrom a leading public health expert and physician, and in the style of Studs Terkel's Working, comes an eye-opening look at what it&’s like to have to work physically hard for your money in America . . .A Living is a vivid portrait of the working lives of the patients who visit Dr. Michael Stein, a primary care doctor in urban America. What makes his patients unique is that they, by and large, do demanding manual labor. Very few have the luxury of working remotely, or seated. Inspired by Studs Terkel&’s classic Working, Stein produces an eye-opening look at what it&’s like to have to work long hours at physical jobs for a paycheck in America. A Living is composed of vignettes, snap shots of people&’s working lives, the dramas, disappointments and frustrations workers have with their colleagues, family co-workers, and supervisors.And yet it also captures the sense of accomplishment and satisfaction, the opportunities for initiative and self-expression that come from doing intricate work with one&’s hands. Work gives Stein&’s patients a sense of identity and a social environment to thrive in.Ultimately, A Living is an extraordinarily powerful and poetic tableaux of working-class America at this moment when manual labor may be the final refuge in the new era of AI.

A Local History of Global Capital: Jute and Peasant Life in the Bengal Delta (Histories of Economic Life)

by Tariq AliBefore the advent of synthetic fibers and cargo containers, jute sacks were the preferred packaging material of global trade, transporting the world's grain, cotton, sugar, tobacco, coffee, wool, guano, and bacon. Jute was the second-most widely consumed fiber in the world, after cotton. While the sack circulated globally, the plant was cultivated almost exclusively by peasant smallholders in a small corner of the world: the Bengal delta. This book examines how jute fibers entangled the delta's peasantry in the rhythms and vicissitudes of global capital.Taking readers from the nineteenth-century high noon of the British Raj to the early years of post-partition Pakistan in the mid-twentieth century, Tariq Omar Ali traces how the global connections wrought by jute transformed every facet of peasant life: practices of work, leisure, domesticity, and sociality; ideas and discourses of justice, ethics, piety, and religiosity; and political commitments and actions. Ali examines how peasant life was structured and restructured with oscillations in global commodity markets, as the nineteenth-century period of peasant consumerism and prosperity gave way to debt and poverty in the twentieth century.A Local History of Global Capital traces how jute bound the Bengal delta's peasantry to turbulent global capital, and how global commodity markets shaped everyday peasant life and determined the difference between prosperity and poverty, survival and starvation.

A Lone Ranger: Real World Strategies for Applying Growth Opportunity Scans, Assessing Product Extensions, and Realizing the Potential of Radical Innovations

by Jay Barney Patricia Gorman Clifford"What I Didn't Learn in Business School" is a fictional account that follows new consultant Justin Campbell as he joins an elite team hired by a chemical firm to assess the potential of a newly developed technology. This chapter finds Justin struggling to get a handle on several different applications for this technology in order to determine the growth opportunity and lay the groundwork for choosing the highest-potential innovations. Learn from his mistakes as he looks for ways to organize information effectively and evaluates strategic opportunities. This chapter was originally published as Chapter 8 of "What I Didn't Learn in Business School: How Strategy Works in the Real World."

A Long Way Home: Migrant worker worlds 1800–2014

by William BeinartIn no other society in the world have urbanisation and industrialization been as comprehensively based on migrant labour as in South Africa. Rather than focusing on the well-documented narrative of displacement and oppression, A Long Way Home captures the humanity, agency and creative modes of self-expression of the millions of workers who helped to build and shape modern South Africa. The book spans a three-hundred-year history beginning with the exportation of slave labour from Mozambique in the eighteenth century and ending with the strikes and tensions on the platinum belt in recent years. It shows not only the age-old mobility of African migrants across the continent but also, with the growing demand for labour in the mining industry, the importation of Chinese indentured migrant workers. Contributions include 18 essays and over 90 artworks and photographs that traverse homesteads, chiefdoms and mining hostels, taking readers into the materiality of migrant life and its customs and traditions, including the rituals practiced by migrants in an effort to preserve connections to “home” and create a sense of “belonging”. The essays and visual materials provide multiple perspectives on the lived experience of migrant labourers and celebrate their extraordinary journeys. A Long Way Home was conceived during the planning of an art exhibition entitled ‘Ngezinyawo: Migrant Journeys’ at Wits Art Museum. The interdisciplinary nature of the contributions and the extraordinary collection of images selected to complement and expand on the text make this a unique collection.