- Table View

- List View

Fintech Regulation and Supervision Challenges within the Banking Industry: A Comparative Study within the G-20 (Palgrave Macmillan Studies in Banking and Financial Institutions)

by Felix I. LessamboStrengthening financial sector regulatory arrangements has been a major focus of the G-20 since the crisis in 2008, and progress in strengthening financial regulations is often cited as its success. Nonetheless, the overall contribution of the G20 as a political forum for the oversight of international financial regulation is diming as FinTech is blurring the boundaries between intermediaries and markets, as well as between digital service providers moving into the financial space, nonbank financial companies, and banks. Along the same line, financial technology is causing paradigm changes to the traditional financial system, presenting both challenges and opportunities. As FinTech grows rapidly, the importance of regulation and supervision becomes more prominent. The three cornerstones of banking: taking deposits, making loans, and facilitating payments are being reassembled functionally and digitally outside of the bank regulatory perimeter by certain firms. Without comprehensive consolidated supervision, no single regulator can see the whole picture and understand how a firm as a whole operates and takes risk. No crypto firm to date is subject to comprehensive consolidated supervision, creating gaps in supervision alongside risks. Countries around the world are taking divergent views on cryptocurrency and other so-called “Web3” technologies based on blockchain. This book aims to provide a comparison between the various available approaches, models, or legislations by identifying certain key legislative policies within the G-20 as they cope with innovative financial technologies, and will be of interest to scholars, students, and practitioners of banking, financial regulation, risk management, and financial technology.

Fintech Regulation in China: Principles, Policies and Practices

by Robin Hui HuangThis is the first book-length treatment of the regulation of financial technology (Fintech) in China. Fintech brings about paradigm changes to the traditional financial system, presenting both challenges and opportunities. At the international level, there has been a fierce competition for the coveted title of global Fintech hub. One of the key enablers of success in this race is regulation. As the world's leader in Fintech, China's regulatory experience is of both academic and practical significance. This book presents a systematic and contextualized account of China's Fintech regulation, and in doing so, tries to identify and analyze relevant institutional factors contributing to the development of the Chinese law. It also takes a comparative approach to critically evaluating the Chinese experience. The book illustrates why and how China's Fintech regulation has been developed, if and how it differs from the rest of the world, and what can be learned from the Chinese experience.

Fintech Wars: Tech Titans, Complex Crypto and the Future of Money

by James da CostaFintech touches every part of our lives, from cashless economies to crypto, and even our climate. This book draws back the curtain on this fascinating world full of friction, failure and fortune.Fintech Wars delves into one of the world's most lucrative and fast-growing sectors. Witness the bold strategies, groundbreaking innovations, and relentless drive that propelled fintech unicorns like PayPal, Nubank and Monzo to transform the world. Featuring interviews with generational founders including Reid Hoffman (LinkedIn), Nigel Morris (Capital One), and Martha Lane Fox (Lastminute.com), the narrators of this book have built companies that represent over one trillion dollars in market capitalization.As the founder of a digital bank, James da Costa is a fintech insider. He draws upon his network and first-hand experiences to offer a fascinating look into the intricacies and motivations behind building billion-dollar disruptors. Step into the fascinating, unpredictable and inspiring world of fintech.

Fintech and Financial Risk in China (Contributions to Finance and Accounting)

by Zhigang Qiu Xiaolin Huo Yue DaiThis book provides a comprehensive overview of the development and status of fintech in China. Occupying core position in fintech development, big data takes on stronger superiority and application value. Meanwhile, blockchain and other technological innovations, which are used to serve data, greatly promote the growth of fintech industry. Furthermore, not only the benefits are illustrated by the authors, but also the financial risks and noise caused by fintech and big data are discussed. By using both academic knowledge and newest real cases in China, this timely book will appeal to practitioners, academics, and policy makers.

Fintech and Islamic Finance: Digitalization, Development and Disruption

by Nafis Alam Lokesh Gupta Abdolhossein ZameniFinancial Technology (Fintech) has revolutionized the financial world as one of the fastest-growing segments in both the technology and financial sectors. With the usage of underlying principles of Blockchain technology, Fintech is bringing the financial community together and making financial services accessible to everyone. Fintech has far-reaching implications for Islamic finance such as banking, investment, insurance (takaful) and wealth management, which are benefitting from this usage. This book provides a comprehensive review of how Fintech is shaping the Islamic finance industry through three key aspects: Digitalization, Development and Disruption. The book will provide insight on the Shariahtech (Fintech in line with Shariah principle) and its application in the Islamic finance industry. The book also gives an overview of Blockchain and Fintech evolution and how they act as the building blocks of the digital financial landscape.Readers of the book will also get a detailed discernment on the Islamic viewpoint on cryptocurrency as well as the application of the smart contract in different Islamic financial services. The book provides students, academics and researchers with a detailed description of the Blockchain and Fintech application in Islamic finance.

Fintech and Sustainability: How Financial Technologies Can Help Address Today’s Environmental and Societal Challenges

by Thomas Walker Maher Kooli Elaheh Nikbakht Harry J. TurtleFintech can improve sustainability, influence policies, and require new regulations. Climate change, water pollution, and non-renewable resources management can all be addressed with fintech innovations. Despite the advantages offered by fintech, opponents warn of potential negative consequences. The application of fintech in sustainability is a double-edged sword requiring further investigation. This book provides an overview of fintech applications and considers their impact on the future of sustainable finance. It explores how financial technologies can enhance the sustainability of investment and corporate decisions and contribute to the fulfillment of the Sustainable Development Goals (SDGs). By considering practitioner and academic views, it examines whether and how fintech can improve sustainable practices, potential threats with possible solutions, and policies and regulations designed to improve sustainability benefits.

Fintech and the Emerging Ecosystems: Exploring Centralised and Decentralised Financial Technologies (Financial Innovation and Technology)

by Alex Zarifis Xusen ChengFinancial technologies, commonly referred to as Fintech, are revolutionizing and reorganizing the financial sector. This digital transformation profoundly impacts society and influences our everyday lives in numerous ways, as financial services intersect with various other services we utilize. This book offers contributions from leading researchers in the field, providing a comprehensive understanding of this multifaceted transformation. It encompasses emerging financial technologies such as cryptoassets, including Bitcoin and Non-Fungible Tokens (NFTs), Decentralized Finance (DeFi), Central Bank Digital Currencies (CBDCs), and the growing significance of Artificial Intelligence (AI) and Generative AI. While the primary audience comprises researchers and academics, practitioners and students can also glean practical insights from its contents. Chapters "A Model of Trust in Central Bank Digital Currency (CBDC) in Brazil: How Trust in a Two-Tier CBDC with Both the Central and Retail Banks Involved Changes Consumer Trust" and "Building Trust in AI: Leadership Insights from Malaysian Fintech Boards" are available open access under a Creative Commons Attribution 4.0 International License via link.springer.com.

Fintech and the Future of Finance: Market and Policy Implications

by Erik Feyen Harish Natarajan Matthew SaalFintech—the application of digital technology to financial services—is reshaping the future of finance. Digital technologies are revolutionizing payments, lending, investment, insurance, and other financial products and services—and the COVID-19 pandemic has accelerated this process. Digitalization of financial services and money is helping to bridge gaps in access to financial services for households and firms and is promoting economic development. Improved access to basic financial services translates into better firm productivity and growth for micro and small businesses, as well as higher incomes and resilience to improve the lives of the poor. Technology can lower transaction costs by overcoming geographical access barriers; increasing the speed, security, and transparency of transactions; and allowing for more tailored financial services that better serve consumers, including the poor. Women can especially benefit. Yet too many people and firms still lack access to essential financial services that could help them thrive. It is time for policy makers to embrace fintech opportunities and implement policies that enable and encourage safe financial innovation and adoption. Fintech and the Future of Finance: Market and Policy Implications explores the implications of fintech and the digital transformation of financial services for market outcomes, on the one hand, and regulation and supervision, on the other hand—and how these interact. The report, which provides a high-level perspective for senior policy makers, is accompanied by notes that focus on salient issues for a more technical audience. As the financial sector continues to transform itself, policy trade-offs will evolve, and regulators will need to ensure that market outcomes remain aligned with core policy objectives. Several policy implications emerge. 1. Manage risks, while fostering beneficial innovation and competition. 2. Broaden monitoring horizons and reassess regulatory perimeters. 3. Review regulatory, supervisory, and oversight frameworks. 4. Be mindful of evolving policy trade-offs as fintech adoption deepens. 5. Monitor market structure and conduct to maintain competition. 6. Modernize and open financial infrastructures. 7. Ensure public money remains fit for the digital world. 8. Pursue strong cross-border coordination and sharing of information and best practices.

Fintech, Digital Currency and the Future of Islamic Finance: Strategic, Regulatory and Adoption Issues in the Gulf Cooperation Council

by Nafis Alam Syed Nazim AliThe banking and financial landscape has been inundated with technology over the last decade, with FinTech, InsurTech and RegTech being just some of the new applications within finance. In the Gulf Cooperation Council (GCC), FinTech is yet to find its feet despite several digital transformation drives initiated by the regional governments in the UAE and Bahrain. In comparison to conventional finance, the use of FinTech within Islamic financial institutions (IFIs) in GCC countries is still in its very early stages. However, the potential disruption that technology may cause for the Islamic finance sector within this region cannot be underestimated. Aiming to highlight, examine and address key strategic, operational and regulatory issues facing IFIs as they make an effort to keep up with the FinTech revolution, this book explores the market positioning, product structure and placement, delivery channels and customer requirements within the GCC market. The authors evaluate the current situation and look forward to future regulation surrounding technology and financial institutions within the GCC. Scholars and students researching Islamic finance and financial technology will find this book an insightful and valuable read, as well as those interested in international finance more generally.

Fintech, Small Business & The American Dream: How Technology Is Transforming Lending and Shaping a New Era of Small Business Opportunity

by Karen G. MillsSmall businesses are the backbone of the U.S. economy. They are the biggest job creators and offer a path to the American Dream. But for many, it is difficult to get the capital they need to operate and succeed.In Fintech, Small Business & the American Dream, former U.S. Small Business Administrator and Senior Fellow at Harvard Business School, Karen G. Mills, focuses on the needs of small businesses for capital and how technology will transform the small business lending market. This is a market that has been plagued by frictions: it is hard for a lender to figure out which small businesses are creditworthy, and borrowers often don’t know how much money or what kind of loan they need. Every small business is different; one day the borrower is a dry cleaner and the next a parts supplier, making it difficult for lenders to understand each business’s unique circumstances. Today, however, big data and artificial intelligence have the power to illuminate the opaque nature of a smallbusiness’s finances and make it easier for them access capital to weather bumpy cash flows or to invest in growth opportunities. Beginning in the dark days following the 2008-9 recession and continuing through the crisis of the Covid-19 Pandemic, Mills charts how fintech has changed and will continue to change small business lending. In the new fintech landscape financial products are embedded in applications that small business owners use on daily basis, and data powered algorithms provide automated insights to determine which businesses are creditworthy. Digital challenger banks, big tech and traditional banks and credit card companies are deciding how they want to engage in the new lending ecosystem. Who will be the winners and losers? How should regulators respond? In this pivotal moment, Mills elucidates how financial innovation and wise regulation can restore a path to the American Dream by improving access to small business credit. An ambitious book grappling with the broad significance of small business to the economy, the historical role of credit markets, the dynamics of innovation cycles, and the policy implications for regulation, this second edition of Fintech, Small Business & the American Dream is relevant to bankers, regulators and fintech entrepreneurs and investors; in fact, to anyone who is interested in the future of small business in America.

Fintech, Small Business & the American Dream: How Technology Is Transforming Lending And Shaping A New Era Of Small Business Opportunity

by Karen G. MillsSmall businesses are the backbone of the U.S. economy. They are the biggest job creators and offer a path to the American Dream. But for many, it is difficult to get the capital they need to operate and succeed. In the Great Recession, access to capital for small businesses froze, and in the aftermath, many community banks shuttered their doors and other lenders that had weathered the storm turned to more profitable avenues. For years after the financial crisis, the outlook for many small businesses was bleak. But then a new dawn of financial technology, or “fintech,” emerged. <P><P> Beginning in 2010, new fintech entrepreneurs recognized the gaps in the small business lending market and revolutionized the customer experience for small business owners. Instead of Xeroxing a pile of paperwork and waiting weeks for an answer, small businesses filled out applications online and heard back within hours, sometimes even minutes. Banks scrambled to catch up. Technology companies like Amazon, PayPal, and Square entered the market, and new possibilities for even more transformative products and services began to appear. <P><P> In Fintech, Small Business & the American Dream, former U.S. Small Business Administrator and Senior Fellow at Harvard Business School, Karen G. Mills, focuses on the needs of small businesses for capital and how technology will transform the small business lending market. This is a market that has been plagued by frictions: it is hard for a lender to figure out which small businesses are creditworthy, and borrowers often don’t know how much money or what kind of loan they need. New streams of data have the power to illuminate the opaque nature of a small business’s finances, making it easier for them to weather bumpy cash flows and providing more transparency to potential lenders. <P><P> Mills charts how fintech has changed and will continue to change small business lending, and how financial innovation and wise regulation can restore a path to the American Dream. An ambitious book grappling with the broad significance of small business to the economy, the historical role of credit markets, the dynamics of innovation cycles, and the policy implications for regulation, Fintech, Small Business & the American Dream is relevant to bankers, fintech investors, and regulators; in fact, to anyone who is interested in the future of small business in America.

Fintech: Frontier and Beyond (China Perspectives)

by Zhong Xu Chuanwei ZouFintech, the integration of technology into the delivery of financial services has revolutionised the world of Finance. This book introduces a new framework to study the concepts that underly Fintech while examining the driving forces and underlying logic behind Fintech-based innovation and predicting the future development of Fintech. The first three parts of the book cover the development and basics of Fintech and its relationship with inclusive finance, while later sections constitute a deep dive into several core issues surrounding Fintech. First, the volume introduces an economic explanation of blockchain and its application in various scenarios based on the token paradigm. Second, it studies digital currency and discusses its impacts on payment systems, financial inclusion, monetary policy, and financial stability. Third, the authors explore how to build a compliant and effective market for data while protecting data privacy, impinging on the future development of AI application, the digital economy and Fintech. Fourth, the book examines public policies related to Fintech, including regulatory technology, the regulation of financial activities of Big Tech companies, and how to promote financial inclusion. The title will appeal to scholars, students, and financial practitioners and regulators in a broad range of areas including economics, finance, technology, and public policy, especially Fintech, blockchain, and digital currency.

Fire & Smoke: Government, Lawsuits, and the Rule of Law

by Michael I. KraussThe state of Mississippi&’s lawsuit against tobacco companies in 1994 was quickly emulated by more than a dozen other states and then the federal government. Not to be outdone, more than a dozen cities and the federal government have followed the City of New Orleans&’s lead and sued gun manufacturers. Do these lawsuits signal new directions for more effective public policy or a new and dangerous trend whereby governments use tort law to achieve public policy objectives they were unable to accomplish legislatively? In this new policy report, so-called government &“recoupment&” lawsuits are carefully examined and found to be flagrant abuses of the constitutional separation of powers, seriously undermining over two hundred years of common-law torts adjudication. Author Michael Krauss, a leading legal scholar on the relationship between tort law and personal freedoms, systematically dissects the tobacco and firearm recoupment lawsuits. He shows how such lawsuits betray every criterion of sound, effective, and just tort law. The lawsuits against gun manufacturers can show no damages, no proximate causation, and no wrongdoing. Similarly, governments have no direct damages to claim against tobacco manufacturers and cannot legally stand in the place of individual smokers or their families. Fire & Smoke concludes that recoupment lawsuits are incompatible with civil freedoms, representative democracy, and the rule of law upon which institutions of a free society depend.

Fire Phone: A get-started-now guide to Firefly, Mayday, Dynamic Perspective, and other new features

by Brian SawyerDive straight into hot Fire phone features you won’t find in any other device—like Firefly, Mayday, and Dynamic Perspective—with this concise hands-on guide. You probably already know how to make calls, text, and take photos with Amazon’s new phone, but where it really shines is in innovative features you’ve never even seen before. This intuitive, easy-to-follow book opens a world of possibilities with the Fire phone, right out of the box.Instantly identify and order just about any product with Firefly—from DVDs, CDs, and books (or their electronic equivalents) to nearly anything else with a barcodeUse Mayday to get live, hands-on tech support and customer service right on your phoneImmerse yourself in 3D games, maps, and apps with the Dynamic Perspective sensor systemNavigate easily with new one-handed (and no-handed!) gestures found only on Fire phone

Fire Prevention Applications

by Brett Lacey Paul ValentineThis NEW updated text presents fire prevention methods for comprehensive risk reduction strategies in detail. Community coalition building to solve present-day community risk challenges is emphasized. <p><p>The book meets the FESHE model Fire Prevention Organization and Management course. It can be used as a guide to implement a modern fire prevention and risk reduction program. It also provides fire prevention organizational structures, staffing options; with emphasis on successfully overcoming the challenges fire prevention and risk reduction bureaus face today.

Fire Safety and Risk Management: for the NEBOSH National Certificate in Fire Safety and Risk Management

by Fire Protection AssociationThis textbook is directly aligned to the NEBOSH National Certificate in Fire Safety and Risk Management, with each element of the syllabus explained in detail. Each chapter guides the student through the syllabus with references to legal frameworks and guidelines. Images, tables, case studies and key information are highlighted within the text to make learning more productive. Covering fire behaviour, safety, management, risk assessment, prevention and the changes to HSG65, the book can also be used as a daily reference by professionals. Written by experts in the field of fire safety Complete coverage that goes beyond the syllabus content making it a useful resource after study Illustrated throughout to enhance understanding

Fire Sale

by Philip MckernanThe ads are everywhere. US real estate at rock-bottom prices. Posh homes in gated communities devalued 50% from a year ago. US real estate agents with nowhere to go in their own backyard are targeting Canada and other countries to attract buyers to the land of the foreclosed and the home of the bushwhacked.As the US housing market remains in crisis and foreign currencies increase in strength relative to the US dollar, foreign investment into real estate in America is reaching new highs, particularly in the sunbelt states. The opportunity to invest in these properties, either as an investment property or a vacation home, is made even more attractive in light of the record number of distressed properties (AKA foreclosures) on the market or in the pipeline due to high levels of unemployment in the US, high consumer debt, and ongoing fallout from the subprime crisis.But what does "opportunity" really look like? What due diligence must an investor do to buy with confidence? What are the pitfalls? The legal and tax considerations? While the property and price may look good on paper, how can you ensure that your investment is a sound one? Philip McKernan and his crack team of experts teach you everything you need to know about investing in distressed properties in the United States, including sourcing distressed properties; building the right team of real estate agent, finance expert, lawyer, and accountant; understanding the tax and legal issues; and having an exit strategy.Make sure you're getting the best deals possible and avoiding any nasty surprises. Be prepared and aware, with Fire Sale: How to Buy US Foreclosures.

Fire Sales and the Financial Accelerator

by David Cook Woon Gyu ChoiA report from the International Monetary Fund.

Fire Someone Today

by Bob PritchettShould you take the time to visit customers and suppliers in person? Absolutely. Who makes the best accountant? A pessimist. What do you do with a good employee who is a jerk? Fire him! Whether you are a young company that's just starting out or a mature business looking to grow, Bob pritchett's hands-on advice and practical examples are a must-read for every manager, business owner, and entrepreneur. Inside this book, you will not find Thirteen Incontrovertible Laws of Excellence. You won't find motivational clichés to frame and put on your desk. And there are no step-by-step instructions for writing a business plan. Instead, in Fire Someone Today, you'll read what Pritchett has discovered through his years of experience as an entrepreneur and small business owner. It is a book about what to do, what not to do, and why. For your business, it could be that one piece of advice that makes all the difference . . . and even give you a few laughs along the way. "A year's worth of lunches with someone who has been way down the road and taken a lot of lumps." ?Guy Kawasaki, Author, The Art of the Start "Made you think! And that's more than you can hope for from the typical business book, that's for sure. Everyone who manages anyone needs to think about the stuff inside." ?Seth Godin, Author, All Marketers are Liars "Bob Pritchett has written a classic for anyone running or starting up a small to mid-sized business. There's compelling information on every page." ?Pat Williams, Senior Vice President, Orlando Magic "Fire Someone Today is a breakthrough for those of us who hate wading through theoretical business books." ?Kevin Cable, Cofounder, Cascadia Capital

Fire Them Up!: 7 Simple Secrets to: Inspire Colleagues, Customers, and Clients; Sell Yourself, Your Vision, and Your Values; Communicate with Charisma and Confidence

by Carmine GalloFire Them Up! will give you the astonishing communication skills that will help you enjoy more successful and fulfilling relationships with colleagues, clients, employees, or anyone else in your personal or professional life. It is full of stories and tactics from some of the worlds most influential people. More than two dozen of todays most inspiring business leaders share their secrets including men and women who run The Ritz-Carlton, Google, Travelocity, Cranium, Cold Stone Creamery, Gymboree, 24-Hour Fitness and many other big-name brands. The book reveals seven simple secrets distilled from the wisdom of leaders, entrepreneurs, and visionaries from different backgrounds, generations and industries. Together, they possess all the tools you need to transform yourself into an extraordinary, electrifying, and enthusiastic leader who communicates with power, passion, confidence and charisma!

Fire Your Boss

by Stephen M. Pollan Mark LevineFire Your Boss And Hire Yourself. Impossible? Not according to nationally bestselling author Stephen M. Pollan. As he says in this new and empowering book, "You don't have to accept your current work situation. You can be in control of your job and your stream of income, so you're never again subject to the whims, prejudices, moods, or circumstances of your so-called boss." In today's difficult work environment, gone are the days of finding satisfaction through your job, gone is the time when your job was secure, and gone are the days when your employer cared about you. This new environment requires new rules, and Pollan has provided surprisingly fresh and intriguing methods for finding "success" on the job. Pollan's bold and unique message begins with the idea that you must "fire your boss." By this he means you can no longer rely on your manager or your company for economic security. Instead, you must put yourself in charge of your working life. In this thought-provoking and counterintuitive career guide, Pollan presents a seven-step program and a series of exercises that give you the confidence, power, and will to achieve the life of your dreams. Once you have changed your mind-set and learned the new rules of the game, you can start the process of moving to a richer, more enriching, and more enjoyable life. And the best part about it? Your boss will love you for it.

Fire Your Resume - Military Edition

by Tom Stein Greg WoodThings have changed, times have changed, and times are tough - especially if you're a military veteran seeking employment in today's economy. This essential guide is designed to help you succeed in your civilian job search. Written by a career military officer and a career expert, TheHireTactics introduces a methodology that includes innovative tools that go far beyond the traditional resume and cover letter. You will learn how to define your value in civilian terms and employ the strategies and tactics necessary to differentiate yourself from the competition and successfully complete your job search mission.Learn the 4 Milestones for Civilian Employment: Packaging - teaches you how to implement new and unique tools that will clearly separate you from your competition. Promotion - introduces strategies and techniques that help you successfully penetrate the hidden job market by broadcasting your value to the business community, not your resume. Product Demonstration - teaches you the techniques to conduct a proactive, strategic interview that will greatly enhance your chances of getting the offer. Pricing - Teaches you how to negotiate the difference between what you're offered and your true worth to the organization.

Fire Your Resume!

by Greg WoodThis essential guide is designed to help you quickly succeed in your search for employment in today's economy. Things have changed, times have changed, and times are tough. Old methods that typically rely on resumes and cover letters no longer work. New strategies and tools are needed for job-hunting success, and you will find them here. The Hire Advantage combines the four key milestones to employment based on Greg Wood's proven job-hunting series, TheHireRoad: Packaging - teaches you how to implement new and unique tools that will clearly separate you from your competition. Promotion - introduces strategies and techniques that help you successfully penetrate the hidden job market by broadcasting your value to the business community, not your resume. Product Demonstration - teaches you the techniques to conduct a proactive, strategic interview that will greatly enhance your chances of getting the offer. Pricing - teaches you how to negotiate the difference between what you're offered and your true worth to the organization.

Fire at Mann Gulch

by Michael A. Roberto Erika M. FerlinsDescribes the 1949 firefighting tragedy in Montana that led to the deaths of 12 smoke jumpers. Explores the myriad of poor decisions by the firefighting crew and their foreman.

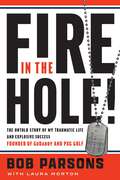

Fire in the Hole!: The Untold Story of My Traumatic Life and Explosive Success

by Bob ParsonsIn Fire in the Hole!, Bob Parsons, founder of GoDaddy, shares his story of extraordinary success as a self-made serial entrepreneur.Born in the tough town of East Baltimore to parents who were inveterate gamblers, billionaire philanthropist Bob Parsons' early years were marked by hardship and financial struggle. While he vowed his own children would never lack for anything, never did he imagine the wealth he would one day amass as the founder of Parsons Technology, GoDaddy, PXG Golf, and YAM Worldwide. In his literary debut, Fire in the Hole!, this extraordinary entrepreneur recounts the exploits of his youth, his hellish days at the mercy of Catholic school nuns, his harrowing tour of combat duty in Vietnam as a US Marine, his pioneering contributions to the software and internet industries, and his latest ventures in power sports, golf, real estate, and marketing. Along the way, we witness his remarkable resilience as he copes with his mother&’s mental illness and his father&’s struggles, battles PTSD resulting from both his childhood and war traumas, and mounts a quest to find new and effective treatments for himself and others who suffer from this affliction. He strongly supports veterans organizations, and believing in the concept of paying it forward, has awarded grants to more than ninety-six charities and organizations worldwide through the Bob & Renee Parsons Foundation. Perhaps the only thing that has come easy to Parsons is his gift for storytelling. His reflections are at turns heartbreaking, heartwarming, hilarious, and inspiring. If ever there were a story about a self-made man whose wealth can be measured as much by the contents of his heart as by the contents of his bank account, this is it. More than anything, Fire in the Hole! is a "can't put down," damn good read!