- Table View

- List View

Investment Implications of Selected WTO Agreements and the Proposed Multilateral Agreement on Investment

by Matthias VockeA report from the International Monetary Fund.

Investment Incentives and Effective Tax Rates in the Philippines: A Comparison With Neighboring Countries

by Alexander Klemm Reza Baqir Dennis BotmanA report from the International Monetary Fund.

Investment Industry Claims Debunked: Smart Personal Finance Management For Ordinary Folks, Before and After Retirement

by Robert P. KurshanThis book is for people who want to know what to do with the money they save: so that it’s there when they need it — to buy a home, pay for college, etc. — but also grows enough so they don’t outlive it. The investment industry is fixated on the importance of maintaining a “balance” of stocks and bonds, shifting to more bonds as one ages. This book challenges this belief by arguing that what’s actually important is to have just enough bonds and cash to support spending needs from a stable source, and to replenish these through the sale of stocks at propitious times when the stock market is not depressed. It features simple mathematical calculations, an explanation of basic financial objects like stocks, bonds, ladders, CDs, ETFs, or annuities, a discussion of how to evaluate financial risk, examinations of insurance, fraud deterrence, dollar cost averaging, benefits of a mortgage, risks of a pension, and general advice about healthcare. Although the book is written to be accessible to those with little or no prior knowledge of finance, the studies and conclusions presented here benefit a multitude of financial investors.

Investment Intelligence From Insider Trading

by H. Nejat SeyhunThe term insider trading refers to the stock transactions of the officers, directors, and large shareholders of a firm. Many investors believe that corporate insiders, informed about their firms' prospects, buy and sell their own firm's stock at favorable times, reaping significant profits. Given the extra costs and risks of an active trading strategy, the key question for stock market investors is whether the publicly available insider-trading information can help them to outperform a simple passive index fund. Basing his insights on an exhaustive data set that captures information on all reported insider trading in all publicly held firms over the past twenty-one years--over one million transactions!--H. Nejat Seyhun shows how investors can use insider information to their advantage. He documents the magnitude and duration of the stock price movements following insider trading, determinants of insiders' profits, and the risks associated with imitating insider trading. He looks at the likely performance of individual firms and of the overall stock market, and compares the value of what one can learn from insider trading with commonly used measures of value such as price-earnings ratio, book-to-market ratio, and dividend yield.

Investment Leadership and Portfolio Management: The Path To Successful Stewardship For Investment Firms (Wiley Finance Ser. #502)

by Brian D. Singer Greg FedorinchikAn industry leader candidly examines the role of investment leadership in portfolio managementInvestment Leadership & Portfolio Management provides a top down analysis of successful strategies, structures, and actions that create an environment that leads to strong macro investment performance and rewarding investor outcomes. By examining how to manage and lead an investment firm through successful investment decision-making processes and actions, this book reveals what it will take to succeed in a radically changed investment landscape. From firm governance and firm structure-for single capability, multi-capability, and investment and product firms-to culture, strategy, vision, and execution, authors Brian Singer, Barry Mandinach, and Greg Fedorinchik touch upon key topics including the differences between leading and managing; investment philosophy, process, and portfolio construction; communication and transparency; and ethics and integrity.Leadership issues in investment firms are a serious concern, and this book addresses those concernsDetails the strong correlation between excellence in investment leadership and excellence in portfolio managementWritten by a group of experienced professionals in the field, including the Chairman of the CFA Institute Board of GovernorsUnderstanding how to operate in today's dynamic investment environment is critical. Investment Leadership & Portfolio Management contains the insights and information needed to make significant strides in this dynamic arena.

Investment Legends

by Barrie DunstanPart-philosophy, part-business strategy and part-biography, Investment Legends provides fascinating insight into the key ingredients required for successful investing, as explored through the experiences and tips of fifteen of the world's leading investors.Drawing on his forty years in the business, leading Financial Review journalist, Barrie Dunstan has travelled the globe interviewing the cast of characters in this book. Throwing the net far and wide, Dunstan's subjects include those virtually born into the business, such as Barton Biggs and Peter Bernstein, as well as others who came to investment via the card tables at Las Vegas or the ski slopes of Switzerland. Each interview provides insights about the legends - who are they, how do they think about investment, what do they believe is most important, why these beliefs matter, and when they might change their mind.In this captivating book, you'll get to meet some of the world's leading lights in the investment world. Share in their secrets to success, and follow their dramatic journeys, led by the guiding hand of wise and insightful author, Barrie Dunstan.

Investment Management

by Chandrasekhar Krishnamurti Ramanna VishwanathSound investment decisions require an in-depth knowledge of the financial markets and available financial instruments. This book provides students and professionals with an understanding of the role and activities of an equity security analyst within the investment process. Emphasis is on understanding the process of analyzing companies; the valuation process; and the challenges of achieving success in a highly competitive capital market. The authors present a comprehensive compendium on the financial theory, the empirical evidence and the mathematical tools that form the underlying principles of investment decisions.

Investment Management

by Joel Rieves Ralph A. Wagner Wayne H. ChernoffPraise for Investment Management "A compelling analysis of the challenges of investment management, and why investment management firms require innovation to succeed. " -Blake Grossman, CEO, Barclays Global Investors "Great investment managers understand that positioning portfolios for clients should not be an act of conformity, but rather a constant journey of shifting fundamentals and opinion. Wayne and Ralph bring this fact to life by addressing some of the key challenges to serious investment thinking, using top-level researchers in their respective fields. For those investment managers and clients who want to go beyond the ordinary. " -Jeff Diermeier, former CEO of CFA Institute and retired CIO of UBS Global Asset Management "The essays in this book provide an invaluable reference point of serious readings for money managers. The works provide the analyst with the most recent scholarship in a single book, presenting ideas and philosophy that will lead me back to its various sections time and time again. " -Kenneth S. Hackel, CFA, President, CT Capital LLC "The crash of 2007-2009 brought a harsh conclusion to a quarter of a century of unprecedented growth and prosperity for the investment management industry, which faces no less a task than reinventing itself. Rieves' and Wagner's contribution to the way forward couldn't be timelier. " -Richard Ennis, Principal, Ennis Knupp + Associates "This book uniformly focuses on the best practices to which investment management professionals should commit. I highly recommend this book to investment managers, sales people, and trustees of pensions, endowments, trusts, and mutual funds. " -Jack Clark Francis, PhD, Professor of Economics and Finance, Bernard Baruch College

Investment Manager Analysis

by Frank J. TraversPraise for Investment Manager Analysis"This is a book that should have been written years ago. It provides a practical, thorough, and completely objective method to analyze and select an investment manager. It takes the mystery (and the consultants) out of the equation. Without question, this book belongs on every Plan Sponsor's desk."--Dave Davenport, Assistant Treasurer, Lord Corporation, author of The Equity Manager Search"An insightful compendium of the issues that challenge those responsible for hiring and firing investment managers. Frank Travers does a good job of taking complicated analytical tools and methodologies and explaining them in a simple, yet practical manner. Anyone responsible for conducting investment manager due diligence should have a copy on their bookshelf."--Leon G. Cooperman, Chairman and CEO, Omega Advisors, Inc."Investment Manager Analysis provides a good overview of the important areas that purchasers of institutional investment management services need to consider. It is a good instructional guide, from which search policies and procedures can be developed, as well as a handy reference guide."--David Spaulding, President, The Spaulding Group, Inc."This book is the definitive work on the investment manager selection process. It is comprehensive in scope and well organized for both the layman and the professional. It should be required reading for any organization or individual seeking talent to manage their assets."--Scott Johnston, Chairman and Chief Investment Officer, Sterling Johnston Capital Management, LP"Investment Manager Analysis is a much-needed, comprehensive review of the manager selection process. While the industry is riddled with information about selecting individual stocks, comparatively little has been written on the important subject of manager selection for fund sponsors. This is a particularly useful guide for the less experienced practitioner and offers considerable value to the veteran decisionmaker as well."--Dennis J. Trittin, CFA, Portfolio Manager, Russell Investment Group

Investment Matters: The Role and Patterns of Investment in Southeast Europe

by Borko HandjiskiThe purpose of this book is to provide policy insights to decision-makers, academics and researchers on investment flows and patterns in Southeast Europe. The report explores some of the determinants of private investment, such as: the financing sources for investment, the contribution of FDI and the role of public investment. It finds that investment rates in Southeast Europe are substantially lower than among the EU-8 and the fast growing East Asian economies, which could explain partly the slower economic growth in Southeast Europe.

Investment Opportunities as Real Options: Getting Started on the Numbers

by Timothy A. LuehrmanIn this article, Timothy A. Luehrman presents a framework that can bridge the gap between the practicalities of real-world capital projects and the higher mathematics associated with formal option-pricing theory. His step-by-step approach maps out the exact relationship between a project's characteristics and the five variables that determine the value of a simple call option on a share of stock. By going through these steps, executives not regularly steeped in finance can discover value hidden in their projects that their standard discounted cash flow analysis would overlook. The analogy between financial options and corporate investments that create future opportunities is both intuitively appealing and increasingly well accepted. Executives readily see that today's investment in R&D, or in a new marketing program, or even in a multiphased capital expenditure can generate the possibility of new products or markets tomorrow. But for many, the leap from the puts and calls of financial options to actual investment decisions has been difficult and deeply frustrating. The calculations required to value real options have been dauntingly complex, and practical how-to advice on the subject has been scarce and mostly aimed at specialists, preferably with Ph.D.s in finance. Luehrman's methodology is designed to be used by general managers, not technical specialists. It deliberately sacrifices absolute precision in order to generate a number "good enough" to provide executives with valuable insight into their most important and complex investment decisions.

Investment Pattern of LICI and Select Private LICs in the Post-reforms Era in India

by Mitrendu Narayan Roy Siddhartha Sankar Saha Shib Pada PatraThe book examines the trends of premium collection and investment portfolio of LICI and selected private life insurers in India in order to compare their performances. Life insurance organizations in India are significant financial institutions in the Indian financial system and play a major role in mobilizing insurance premium from the household sectors and investing it in the financial markets for productive purposes. The book aims to assist life insurance companies in evaluating their performance in terms of their premium mobilization and investment in Government and other approved securities, infrastructure securities, securities approved by the Insurance Regulatory and Development Authority of India (IRDAI) and other than approved securities as per the provision of IRDA (Investment) (Fifth Amendment) Regulation, 2013. Against this backdrop, the theme of the book is particularly relevant because life insurance companies play a vital role in channelizing small savings into productive sector investment to promote economic development of the nation.

Investment Performance Measurement

by Todd Jankowski Cfa Philip Lawton CipmPraise for Investment Performance Measurement"This volume contains the insights of more than fifty prominent authorities on performance measurement. It is a must-have, must-read book for anyone involved in measuring, analyzing, or explaining investment results."-John Schlifske, CFA,President and Chief Executive Officer, Russell Investments"Investment Performance Measurement: Evaluating and Presenting Results should be required reading for investors as well as investment performance professionals. This collection conveniently brings together some of the definitive texts on performance and risk analysis that are core to the investment profession."-Frances Barney, CFA,Managing Director, BNY Mellon Asset Servicing Performance & Risk Analytics"It is vitally important that performance analysts remain well versed in the academic work that has been published in their field. This book is unique in that it assembles some of the most important papers in the field of performance measurement into one volume. This book should be read by all performance analysts who are serious about advancing in their field."-Neil Riddles, CFA, CIPM,Hansberger Global Investors, Inc.

Investment Philosophies

by Aswath DamodaranThe guide for investors who want a better understanding of investment strategies that have stood the test of timeThis thoroughly revised and updated edition of Investment Philosophies covers different investment philosophies and reveal the beliefs that underlie each one, the evidence on whether the strategies that arise from the philosophy actually produce results, and what an investor needs to bring to the table to make the philosophy work.The book covers a wealth of strategies including indexing, passive and activist value investing, growth investing, chart/technical analysis, market timing, arbitrage, and many more investment philosophies.Presents the tools needed to understand portfolio management and the variety of strategies available to achieve investment successExplores the process of creating and managing a portfolioShows readers how to profit like successful value growth index investorsAswath Damodaran is a well-known academic and practitioner in finance who is an expert on different approaches to valuation and investmentThis vital resource examines various investing philosophies and provides you with helpful online resources and tools to fully investigate each investment philosophy and assess whether it is a philosophy that is appropriate for you.

Investment Policies in the Arab Countries

by Said El-NaggarA report from the International Monetary Fund.

Investment Policy at the Hewlett Foundation

by Luis M. ViceiraIn early January 2005, Laurance Hoagland Jr., VP and CIO of the William and Flora Hewlett Foundation (HF), and his investment team met to finish their recommendations to the HF Investment Committee for a new asset allocation policy for the foundation's investment portfolio. If the proposal was approved, HF would adopt a new asset allocation policy that included a substantial reduction in the overall exposure of the investment portfolio to domestic public equities and a significant increase in the allocation to absolute return strategies and TIPS. Hoagland and this team also needed to decide on a complementary recommendation to the HF Investment Committee to pledge approximately 5% of the total value of the portfolio to Sirius V, the latest fund at Sirius Investments, which specialized in global distressed real estate investments.

Investment Project Design

by Lech Kurowski David SussmanMake more informed project investment decisions by knowing what issues to examine in the planning process and how to analyze their impacts Poor or insufficient planning is primarily responsible for the inordinate number of idle and rusting capital facilities around the world, with investment decisions often made on the basis of either intuition or inadequate analysis. Investment Project Design: A Guide to Financial and Economic Analysis with Constraints alerts potential investors and other stakeholders to precipitous changes in the investment milieu as a result of constraints on resources and infrastructure, economic and political turmoil, and population growth. The guide Includes descriptions of specific methods of financial and economic analysis for new investments and for expansion of an existing enterprise Covers project risk assessment, mitigation and avoidance Provides real-life case studies, adapted for presentation, and addresses the design of projects large and small, as well as those in both private and public sectors Features spreadsheet layouts and computations Investment Project Design is the ultimate resource in the methods of designing and appraising investment projects

Investment Risk and Uncertainty

by Steven P. GreinerValuable insights on the major methods used in today's asset and risk management arenaRisk management has moved to the forefront of asset management since the credit crisis. However, most coverage of this subject is overly complicated, misunderstood, and extremely hard to apply. That's why Steven Greiner--a financial professional with over twenty years of quantitative and modeling experience--has written Investment Risk and Uncertainty. With this book, he skillfully reduces the complexity of risk management methodologies applied across many asset classes through practical examples of when to use what.Along the way, Greiner explores how particular methods can lower risk and mitigate losses. He also discusses how to stress test your portfolio and remove the exposure to regular risks and those from "Black Swan" events. More than just an explanation of specific risk issues, this reliable resource provides practical "off-the-shelf" applications that will allow the intelligent investor to understand their risks, their sources, and how to hedge those risks.Covers modern methods applied in risk management for many different asset classesDetails the risk measurements of truly multi-asset class portfolios, while bridging the gap for managers in various disciplines--from equity and fixed income investors to currency and commodity investorsExamines risk management algorithms for multi-asset class managers as well as risk managers, addressing new compliance issues and how to meet themThe theory of risk management is hardly ever spelled out in practical applications that portfolio managers, pension fund advisors, and consultants can make use of. This book fills that void and will put you in a better position to confidently face the investment risks and uncertainties found in today's dynamic markets.

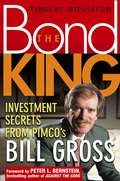

Investment Secrets from PIMCO's Bill Gross

by Timothy MiddletonPraise For Investment Secrets From PIMCO's Bill Gross "No investor is held in higher regard by his peers than Bill Gross. His understanding of the markets and his insights on how to profit from them are unparalleled. Now, Tim Middleton takes you into Gross's world for an insider's view on how the world of finance really works. If this book were a bond, it would be AAA rated with a double-digit yield." -DON PHILLIPS, Managing Director, Morningstar, Inc. "The secret to investment success is discipline. In bonds, nobody has displayed better discipline than Bill Gross. And nobody has done a better job of explaining Gross's methods, and instructing private investors how they can exploit his approach, than Tim Middleton." -JON MARKMAN, Columnist, CNBC on MSN Money "Warren Buffett, John Neff, Bill Miller, Peter Lynch-the stock market has always had dominant personalities whose long-term success becomes legend. In the bond market, that dominant personality is Gross." -FORTUNE "Bill Gross is the Emeril Lagasse of bond managers." -FORBES "If you want to get a stock mutual fund manager steamed, ask why his fund can't beat bond guru Bill Gross." -USA TODAY

Investment Strategies Optimization based on a SAX-GA Methodology

by Rui F.M.F. Neves Nuno C.G. Horta António M.L. CanelasThis book presents a new computational finance approach combining a Symbolic Aggregate approximation (SAX) technique with an optimization kernel based on genetic algorithms (GA). While the SAX representation is used to describe the financial time series, the evolutionary optimization kernel is used in order to identify the most relevant patterns and generate investment rules. The proposed approach considers several different chromosomes structures in order to achieve better results on the trading platform The methodology presented in this book has great potential on investment markets.

Investment Strategies of Hedge Funds (The Wiley Finance Series #577)

by Filippo StefaniniOne of the fastest growing investment sectors ever seen, hedge funds are considered by many to be exotic and inaccessible. This book provides an intensive learning experience, defining hedge funds, explaining hedge fund strategies while offering both qualitative and quantitative tools that investors need to access these types of funds. Topics not usually covered in discussions of hedge funds are included, such as a theoretical discussion of each hedge fund strategy followed by trading examples provided by successful hedge fund managers.

Investment Strategies: A Practical Approach to Enhancing Investor Returns

by Bill JiangThis book is a practical and unique investment resource designed to guide investors towards successful investing in the financial markets. It provides a selection of time-tested investment strategies to help investors enhance returns. Factor investing is positioned between active management and passive investing to combine their advantages. The book provides comprehensive coverage of common style factors such as quality and momentum in response to the rising investor interest in factor strategies. It presents a detailed description of the multifactor approach regarding its principle, investment merits and construction methods. The book also covers sustainable investing as it continues to rise in prominence across the investment sector. It employs an abundance of financial data, real cases and practical examples to help the audience understand different investment strategies in an interesting and informative way. The book is primarily written for private investors and investment practitioners such as equity analysts and investment advisors. It is also suitable for university students who are interested in learning practical investment strategies and traditional asset classes.

Investment Theory and Risk Management

by Steven PetersonA unique perspective on applied investment theory and risk management from the Senior Risk Officer of a major pension fundInvestment Theory and Risk Management is a practical guide to today's investment environment. The book's sophisticated quantitative methods are examined by an author who uses these methods at the Virginia Retirement System and teaches them at the Virginia Commonwealth University. In addition to showing how investment performance can be evaluated, using Jensen's Alpha, Sharpe's Ratio, and DDM, he delves into four types of optimal portfolios (one that is fully invested, one with targeted returns, another with no short sales, and one with capped investment allocations). In addition, the book provides valuable insights on risk, and topics such as anomalies, factor models, and active portfolio management. Other chapters focus on private equity, structured credit, optimal rebalancing, data problems, and Monte Carlo simulation.Contains investment theory and risk management spreadsheet models based on the author's own real-world experience with stock, bonds, and alternative assetsOffers a down-to-earth guide that can be used on a daily basis for making common financial decisions with a new level of quantitative sophistication and rigorWritten by the Director of Research and Senior Risk Officer for the Virginia Retirement System and an Associate Professor at Virginia Commonwealth University's School of BusinessInvestment Theory and Risk Management empowers both the technical and non-technical reader with the essential knowledge necessary to understand and manage risks in any corporate or economic environment.

Investment Treaty Arbitration as Public International Law

by Eric De BrabandereInvestment treaty arbitration is fast becoming one of the most common methods of dispute settlement in international law. Despite having ancient roots, the private interests in international investment relations remain in conflict with the need for the recognition of the public international law features of the arbitral procedure. This book, which presents an account of investment treaty arbitration as a part of public international law - as opposed to commercial law - provides an important contribution to the literature on this subject. Eric De Brabandere examines the procedural implications of conceiving of investment treaty arbitration in such a way, with regards to issues such as the principles of confidentiality and privacy, and remedies. The author demonstrates how the public international law character of investment treaty arbitration derives from and has impacted upon the dispute settlement procedure.

Investment Treaty Law and Climate Change

by Tomás Restrepo RodríguezThe book deals with the question whether the investment treaty law system could be harmonized with the climate change international legal framework and the climate interest that lies beyond. The answer to this research question is divided into three parts. The first examines the relevance of the climate change international legal framework in investment treaty disputes as a natural pre(logical)interpretative stage. The second focuses on the BIT’s content-interpretation, which is the orthodox approach to solve the fragmentation between the system of investment treaty law and the system of international climate change law. Finally, the third part tackles this fragmentation through a heterodox approach that is grounded in the direct application of climate change principles through law ascertainment. Apart from concluding that harmonization between investment treaty law and international climate change law is possible through the orthodox approach to the expropriation and the FET standards, as well as through the direct application of the climate change precautionary principle and the CBDRRC principle − heterodox approach, the book suggests that tribunals are expected soon to openly address climate change disputes in their rulings.