- Table View

- List View

Scaling a Startup: People and Organizational Issues

by Thomas R. Eisenmann Alison Berkley WagonfeldThis note discusses the organizational challenges that startups often encounter as they begin to scale rapidly, along with approaches to addressing these challenges suggested by scholars, investors, and experienced entrepreneurs. The challenges fall into five broad areas: the need to formalize organizational structure; executive transitions; the need for management systems/processes; evolution of the board of directors role; and, preservation of an entrepreneurial culture.

Scaling at Chief

by Jeffrey J. Bussgang Julia Kelley Katherine Coffman Kathleen L. McGinn Katherine ChenChief is a New York-based peer network that provides mentorship, support, networking opportunities, and a sense of community to women executives. Co-founders Carolyn Childers and Lindsay Kaplan launched the company in January 2019, and just two months later, Chief has 400 members and a growing waiting list. Now, Childers and Kaplan must determine how aggressively to scale Chief's model to other cities. How much money should they raise in Chief's Series A, and when? Which cities should they expand to first? What are the potential risks of moving too fast, and how can they best mitigate them? For more background on Childers and Kaplan's decision to found Chief, please see "Chief: Role for Carolyn Childers" (HBS No. 920-019) and "Chief: Role for Lindsay Kaplan" (HBS No. 920-020).

Scaling for Success: People Priorities for High-Growth Organizations

by Dr. T. Brad Harris Andrew C. BartlowManaging a high-growth organization requires both strategy and adaptability. Unfortunately, start-up founders and executives seeking to scale up to the next level find all too frequently that growth turns into chaos. Rather than laying the groundwork for the future, organizations get stuck by covering up complex problems with unsustainable band-aids and duct-tape fixes, implementing anecdote-based solutions from the latest tech-industry unicorns or leadership books, and relying on too much on-the-fly learning from inexperienced managers.This book is the definitive guide for leaders of high-growth organizations seeking to understand and execute the people-management principles that are essential to continued success. Combining a wealth of practical experience, well-grounded academic research, and easy-to-apply frameworks, Andrew Bartlow and T. Brad Harris offer a practical toolkit that founders, functional leaders, and managers of people can use to rethink their practices to meet their organizations’ needs. They help readers identify the core people-management programs and practices that are best for an organization at its current stage and size while also supporting a foundation for continued development and the capacity to adapt to inevitable surprises. Practical, actionable, and supplemented with numerous diagnostic tools and illustrative examples, Scaling for Success is a must-have playbook for organizational leaders pursuing smart and sustainable growth.

Scaling the Tail: Managing Profitable Growth in Emerging Markets

by Gerardo R. Ungson Seung Ho Park Andrew CosgroveThis book discusses the pitfalls of traditional scaling methods and presents a framework for a different type of profitable growth for multinational companies in emerging markets: "scaling the tail. " By extending more recent advances in value-distribution, in which peripheral sales (those in the "tail") outnumber traditional mass-sales (those in the center of any distribution), the authors provide fine-grained insights into how multinational firms in the consumer goods and retailing sectors in emerging markets focus on specialized market niches using high-end brands, flanking particular segments and product-categories, developing deeply nuanced localization strategies, and installing supportive management systems. These findings are based on in-depth field interviews, along with a survey of 253 managers in 10 countries, conducted under the auspices of a collaborative Ernst and Young team and the Economist Intelligence Unit.

Scaling up Business Solutions to Social Problems

by Olivier KayserA silent revolution is underway, as entrepreneurs challenge prevalent notions of business motives and methods to invent market-based solutions to eradicate social injustice. Yet many fail to succeed. Based on original research, the authors uncover why impressive solutions fail to scale up, featuring global case studies and practical solutions.

Scaling up Business Solutions to Social Problems: A Practical Guide for Social and Corporate Entrepreneurs

by O. Kayser V. BudinichA silent revolution is underway, as entrepreneurs challenge prevalent notions of business motives and methods to invent market-based solutions to eradicate social injustice. Yet many fail to succeed. Based on original research, the authors uncover why impressive solutions fail to scale up, featuring global case studies and practical solutions.

Scaling up Climate Mitigation Policy in Germany (Imf Working Papers)

by Simon Black, Ruo Chen, Aiko Mineshima, Victor Mylonas, Ian Parry, and Dinar PrihardiniA report from the International Monetary Fund.

Scam Me If You Can: Simple Strategies to Outsmart Today's Rip-off Artists

by Frank AbagnaleAre you at risk of being scammed? Former con artist and bestselling author of Catch Me If You Can Frank Abagnale shows you how to stop scammers in their tracks.Maybe you're wondering how to make the scam phone calls stop. Perhaps someone has stolen your credit card number. Or you've been a victim of identity theft. Even if you haven't yet been the target of a crime, con artists are always out there, waiting for the right moment to steal your information, your money, and your life.As one of the world's most respected authorities on the subjects of fraud, forgery, and cyber security, Frank Abagnale knows how scammers work. In Scam Me If You Can, he reveals the latest tricks that today's scammers, hackers, and con artists use to steal your money and personal information--often online and over the phone. Using plain language and vivid examples, Abagnale reveals hundreds of tips, including: * The best way to protect your phone from being hacked * The only time you should ever use a debit card * The one type of photo you should never post on social media * The only conditions under which you should use WiFi networks at the airport * The safest way to use an ATM With his simple but counterintuitive rules, Abagnale also makes use of his insider intel to paint a picture of cybercrimes that haven't become widespread yet.

Scambusters!

by Ron SmithScambusters! is a working manual senior citizens can use to defend themselves against the most common scams aimed at the elderly. It provides readers with a comprehensive approach to identifying scams in the making, and shows them specific prevention tools and how to use them. Inside, you'll find step-by-step instructions, helpful anecdotes, and references to dozens of consumer organizationals and government agencies devoted to thwarting swindlers. Weather buying mutual funds, repairing a car, purchasing drugs from online pharmacies, or taking out loans on your home, Scambusters! will protect seniors when they need it.

Scammed: How to Save Your Money and Find Better Service in a World of Schemes, Swindles, and Shady Deals

by Christopher ElliottA leading consumer advocate reveals how to protect your money, time, and integrity from corrupt businesses Once upon a time store prices were simple and fair, businesses stood behind their products with guarantees free of fine print and loopholes, and companies genuinely seemed to care about their valued customers--but those days are long gone. In this groundbreaking exposé, consumer advocate Christopher Elliot reveals the broken relationship between American consumers and businesses and explains how companies came to believe that fooling their customers was a viable, and profitable, business plan. Scammed explores how companies control information to mislead, distort the truth, and even outright lie to their consumers. Exposes the various ways companies have led their war against information--from seductive ads, disingenuous fine print, and unconventional promotions that involve seeding discussion forums and blogs with company-friendly comments Offers consumers insider knowledge of the system, reasonable expectations, and a clear understanding of the games businesses play Christopher Elliott is one of the nation's foremost consumer advocates Protect yourself, your time, and your money from the predators of the consumer world. Armed with knowledge, readers will become far more discerning and every business's worst nightmare.

Scammed: Learn from the Biggest Consumer and Money Frauds How Not to Be a Victim

by Gini Graham ScottDrawn from the personal experience of dozens of victims, including the author's own encounters, Scammed exposes the most prevalent consumer and money scams lurking in modern society. With so many people falling prey to a wide variety of frauds due to increasing vulnerability on the anonymous Internet, an exposé has never been timelier. This recounts the stories of victims of over two dozen different types of scams, and what they did to recover. <p><p> The chilling tales and details of these scams are interspersed with the wisdom of how each one can be dealt with and avoided. Readers will take away from the shocking stories confidence that they have gained the knowledge and preparedness to avoid being Scammed.

Scandal (The Tainted series #1)

by Aimee DuffyFunny and provocative, prepare to fall in love with Scandal.What had she done?Branded a cheater and wild Playboy, Sebastian Collins’ glittering career as a pro-tennis player is almost over – thanks to an ex-fiancé set on revenge. His jet set lifestyle is cut short when his manager insists he salvage what’s left of his reputation.Alicia Simpson, PR Maven and daughter of a powerful and respected Earl, is brought in to salvage Sebastian’s image and restore him to glory. But Alicia has problems of her own - her past has broken her in more ways than one and she’s determined to change.Not even her new client, charming bad boy Sebastian, can hold her back. At least, until she gets to know the man beneath the media spotlight,

Scandal in a Small Town: Understanding Modern Hungary Through the Stories of Three Families

by Marida C. HollosPart of "ASPA Classics" series, this book compiles various contributions to the theory and practice of performance measurement that have been published in various journals affiliated with the American Society for Public Administration. This book includes methods and techniques for developing effective performance measurement systems.

Scandinavia and South America—A Tale of Two Capitalisms: Essays on Comparative Developments in Trade, Industrialisation and Inequality since 1850 (Palgrave Studies in Economic History)

by Jorge Álvarez Svante PradoThis book takes a comparative approach to economic history to offer ways to increase our understanding of the divergence between South America and Scandinavia. In particular, the book aims to deepen our understanding of why the two groups of countries have set out on radically different pathways with regard to industrialisation, long-term economic growth and income distribution. The book draws together the results of two separate projects focusing on this comparison. The first of these projects focuses on two of the so-called settler societies of South America, namely Uruguay and Argentina, sometimes called the Pampas region. Australia and New Zealand, two other settler societies, are also considered, adding a further contrasting effect. These settler societies are compared with Scandinavia, in its broad terms, including Sweden, Denmark, Norway and Finland. The second of these projects focuses on comparisons between Brazil and Sweden. Together, the two projects have engaged the minds of economic historians from Brazil, Uruguay and Sweden. This book will be of interest to researchers and students in economic history and economic development more broadly.

Scandinavian Airlines System

by John J. KaoDiscusses the fostering of entrepreneurship and innovation in the large corporation. It traces the development and history of Scandinavian Airlines System (SAS) from 1946 to the present with particular emphasis on the leadership of Jan Carlzon, CEO from 1981 to the present. He transformed the company's culture from a technical to a marketing force through personal leadership, internal corporate communications training, human resource policies and procedures, and other organizational tools.

Scapegoating: How Organizations Assign Blame

by Maurizio CatinoA large cruise ship sinks after hitting some outcropping rocks near the shore. Who is to blame? In the face of negative events – accidents, corporate scandals, crises and bankruptcies – there are two organizational strategies for managing blame. The first is to take full responsibility for the event and to implement adequate corrective measures. The second is to create one or more scapegoats by transferring blame to some of the people directly involved in the event. In this way, the organization can appear blameless and avoid costly remedial interventions. Reappraising the Costa Concordia shipwreck and other well-known cases, Catino analyzes the processes and mechanisms behind creating the 'organizational scapegoat.' In doing so, Catino highlights the limits of explanations centered on guilt and individual solutions to organizational problems, and underlines the need for a different civic epistemology.

Scarcity and Growth Reconsidered (RFF Environmental and Resource Economics Set)

by V. Kerry SmithCurrent views on resource availability are examined, along with the original Barnett-Morse thesis of resource supply. Originally published in 1979

Scarcity and Growth: The Economics of Natural Resource Availability (RFF Environmental and Resource Economics Set)

by Harold J. Barnett Chandler MorseIn this classic study, the authors assess the importance of technological change and resource substitution in support of their conclusion that resource scarcity did not increase in the Unites States during the period 1870 to 1957. Originally published in 1963

Scarcity and Modernity (Routledge Library Editions: Environmental and Natural Resource Economics)

by Nicholas XenosOriginally published in 1989. In this book Nicholas Xenos argues that the assumption that scarcity is a universal human condition is far from universal but rather a product of western influence. Informed by the work of Baudrillard, Bourdieu, Girard, and Sahlins, this historical narrative of scarcity incorporates interpretations of texts and practices from eighteenth-century London to contemporary New York. Lucid and elegant in style, Scarcity and Modernity will appear to those with interests in social and political thought and cultural criticism.

Scarcity, Conflicts, and Cooperation: Essays in the Political and Institutional Economics of Development

by Pranab BardhanThis wide-ranging review of some of the major issues in development economics focuses on the role of economic and political institutions.

Scarcity: A History from the Origins of Capitalism to the Climate Crisis

by Carl Wennerlind Fredrik Albritton JonssonA sweeping intellectual history of the concept of economic scarcity—its development across five hundred years of European thought and its decisive role in fostering the climate crisis.Modern economics presumes a particular view of scarcity, in which human beings are innately possessed of infinite desires and society must therefore facilitate endless growth and consumption irrespective of nature’s limits. Yet as Fredrik Albritton Jonsson and Carl Wennerlind show, this vision of scarcity is historically novel and was not inevitable even in the age of capitalism. Rather, it reflects the costly triumph of infinite-growth ideologies across centuries of European economic thought—at the expense of traditions that sought to live within nature’s constraints.The dominant conception of scarcity today holds that, rather than master our desires, humans must master nature to meet those desires. Albritton Jonsson and Wennerlind argue that this idea was developed by thinkers such as Francis Bacon, Samuel Hartlib, Alfred Marshall, and Paul Samuelson, who laid the groundwork for today’s hegemonic politics of growth. Yet proponents of infinite growth have long faced resistance from agrarian radicals, romantic poets, revolutionary socialists, ecofeminists, and others. These critics—including the likes of Gerrard Winstanley, Dorothy Wordsworth, Karl Marx, and Hannah Arendt—embraced conceptions of scarcity in which our desires, rather than nature, must be mastered to achieve the social good. In so doing, they dramatically reenvisioned how humans might interact with both nature and the economy.Following these conflicts into the twenty-first century, Albritton Jonsson and Wennerlind insist that we need new, sustainable models of economic thinking to address the climate crisis. Scarcity is not only a critique of infinite growth, but also a timely invitation to imagine alternative ways of flourishing on Earth.

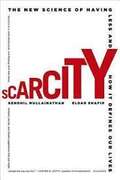

Scarcity: The New Science Of Having Less And How It Defines Our Lives

by Sendhil Mullainathan Eldar ShafirIn the blockbuster tradition of Freakonomics, a Harvard economist and a Princeton psychology professor team up to offer a surprising and empowering new way to look at everyday life, presenting a paradigm-challenging examination of how scarcity - and our flawed responses to it - shapes our lives, our society, and our culture. Why do successful people get things done at the last minute? Why does poverty persist? Why do organizations get stuck firefighting? Why do the lonely find it hard to make friends? These questions seem unconnected, yet Sendhil Mullainathan and Eldar Shafir show that they are all are examples of a mindset produced by scarcity. Drawing on cutting-edge research from behavioral science and economics, Mullainathan and Shafir show that scarcity creates a similar psychology for everyone struggling to manage with less than they need. Busy people fail to manage their time efficiently for the same reasons the poor and those maxed out on credit cards fail to manage their money. The dynamics of scarcity reveal why dieters find it hard to resist temptation, why students and busy executives mismanage their time, and why sugarcane farmers are smarter after harvest than before. Once we start thinking in terms of scarcity and the strategies it imposes, the problems of modern life come into sharper focus.